Why We Decided to Offer Services for a Flat Fee

And How You Have the Most to Gain!

June 9th, 2016 by John Anderson – Be the first to commentPosted in Fees, How to be a Successful Investor, Investing, Successful

At Cypress Wealth Management, nothing inspires us more than helping clients turn their dreams into reality. In order to accomplish our mission, we need to understand our client’s values and ideal vision. It’s only then that we dig into the numbers and help them allocate their resources in a way that improves their overall sense of fulfillment and quality of life.

Letting an outsider in on your most personal financial secrets is nerve racking, so hiring an advisor is a major decision. There must be an enormous level of comfort and trust between you. After all, you’re entrusting them to help you successfully navigate your financial future!

That’s why hiring an advisor who is required to work in your best interest is critical. An elite advisor will go out of his way to remove conflicts of interest and operate in a fashion that puts your needs first. How you pay that advisor is just as important.

From commissions to fees, there are still many ways to pay for the help you need. The best method is one that removes as many conflicts as possible which is why we use a flat fee model. While it’s not the industry standard, we think it should be!

A move in the right direction

Over the past several decades, the financial services industry has moved away from transaction-oriented compensation to asset based fees. On the surface, this seems like a good thing. Removing the financial incentive for brokers to actively churn accounts is a huge step in the right direction.

Today, as the industry continues to transition from commissions, several different compensation models have emerged. Some are still compensated through commissions made on products that they sell you – think annuity sales. Others are compensated on a mixture of fees and commissions – think main street firms that are on every corner.

Compensation based on the amount of your investable assets has emerged as one of the most common methods. This is known as an asset under management (AUM) fee.

A typical example of this type of arrangement is a client who has $1,000,000 or less to invest will normally pay an average of 1% for advice. Maybe more.

For example, a client with a $500,000 portfolio will pay $5,000 and a client with $1,000,000 will arbitrarily pay $10,000 in fees for the same advisor. This is typical across the industry with trillions of dollars managed this way.

But why? To us, It’s like going to the grocery store and purchasing your produce based on YOUR weight. You might pay more or less than the guy behind you for the same product!

In our opinion, a huge falsehood remains entrenched in an industry that still believes the relative value of an investor’s portfolio ought to determine the fees!

A Different Approach

We intend to change that, at least for our own clients. Rather than setting our clients fees based on the size of their assets, we have built a flat fee model around the services we provide. The way a professional should operate.

We feel that a flat annual fee based on the complexity of your personal financial situation and the actual services you are using is more appropriate than the traditional assets under management model. Why should some clients pay more to receive the same financial service?

Our clients benefit the most from this model. Since our compensation is not affected by transactions or by the amount of assets that we manage in a particular account, we are free to help our clients allocate their resources in a way that is best for them – without the conflict of gathering assets to increase our fees. We truly enjoy knowing we have given our clients this peace of mind.

Does it Really Matter?

While there are many ways that a great advisor brings value to your financial life, for the sake of this article, let’s focus solely on fees.

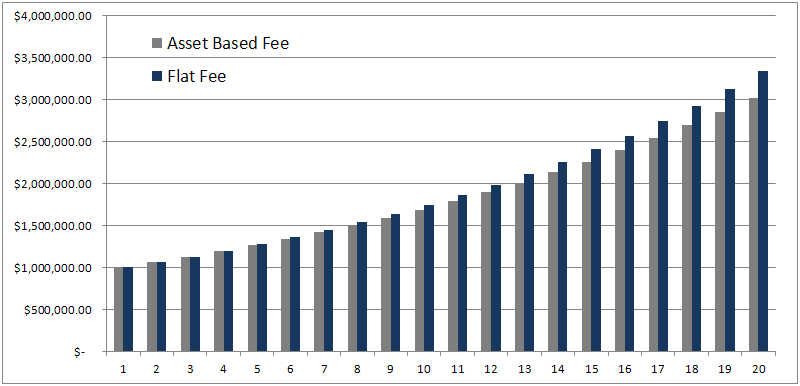

Let’s examine the difference between a flat fee and the typical 1% annual investment advisory fee over a 20 year period. The difference in final wealth can be significant.

For example, assume two investors both with a $1,000,000 portfolio who invest over a 20 year time frame with a 7% rate of return. Investor A works with an advisor who charges a typical 1% AUM fee while Investor B works with an advisor who charges a flat annual fee of $7,500. Also, for the sake of argument, let’s assume that both advisors are very skilled and the level of service that each investor receives is comparable.

Over 20 years, Investor A will lose over $310,000 in wealth due to fee erosion as compared to Investor B working with a flat annual fee. You see, as the balance in Investor A’s account rose, so did the compensation he was paying to his advisor. Rising from $10,000 in year one to $30,000 in year 20.

That would be a fine model if the value of the services you received also rose by $20,000! However, that is highly unlikely.

The chart below shows the comparison of final wealth over 20 years. As time goes on, asset based fees really begin to drag on Investor A’s final wealth.

Growth of Wealth

Investor A in this scenario paid approximately $368,000 or 12% of her final wealth in fees over 20 years while Investor B paid roughly $150,000 or 5% of her final wealth in fees to their advisor.

Cumulative AUM vs Flat Fees Paid Over 20 Years

Both investors received the same level of service and expertise, but Investor B was clearly the winner in terms of final wealth.

Paying a professional for their time and expertise based on the services you are receiving puts extra wealth in your pocket. Also, an advisor who is paid based on the amount of assets they manage may be tempted to provide advice that keeps more of your money under their management. Paying a flat fee for advice, on the other hand, gives you peace of mind that your advisor is truly looking out for you.

Experience the Difference

We believe the financial services industry will eventually get to the flat fee model as it matures from a sales job to a profession. In the meantime, If you are curious to know what it’s like to have the peace of mind knowing you are working with a professional who charges based on services provided, then I invite you to sign up for a free initial consultation.

We’ll provide you with our initial thoughts about your current financial situation, your investments, and your financial plan. We’ll also provide you with a written proposal of what it would cost to work with us – all with absolutely no obligation.

Email: john@cypresswm.com or call: 901-292-3596

Latest posts by John Anderson (see all)

- 2018 Q3 Quarterly Market Review - October 8, 2018

- 2018 Q2 Quarterly Market Review - July 18, 2018

- 2018 Q2 Insights - July 18, 2018

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. Investing involves risk including loss of principal.